- Published on: Jan 20, 2024

- 3 minute read

- By: Secondmedic Expert

Self-Employed Security: The Vital Role Of Life Insurance

As self-employed individuals, the rollercoaster ride of entrepreneurship prompts us to contemplate life's uncertainties. The unpredictable journey necessitates a safety net, a shield against unforeseen challenges. In this blog, we unravel a pivotal facet of financial planning for the self-employed: life insurance. Why is it indispensable in this dynamic landscape? Life insurance transcends being a mere financial instrument; it evolves into a protective fortress, ensuring stability in the face of the unexpected. It becomes a beacon of security for both ourselves and our loved ones. Join us on this exploration as we delve into the profound significance of life insurance, understanding its role in not just shielding against risks, but also in fostering a sense of reassurance and preparedness amidst the twists and turns of the entrepreneurial voyage.

The Significance of Life Insurance

Understanding Life Insurance: In the dynamic landscape of self-employment, life insurance stands as a guardian angel, offering financial security and peace of mind. This protective shield is not just for you; it extends its wings to your loved ones. Let's dissect the significance of each facet:

Life Insurance Policy - A Foundation of Security

-

A life insurance policy is not just a piece of paper; it is a contract of trust between you and your loved ones.

-

This financial safety net ensures that your family is shielded from the burden of debts and financial obligations in the event of your untimely demise.

Term Policy Life Insurance - Tailored for the Self-Employed

-

As self-employed individuals, opting for a term policy life insurance is a strategic move.

-

This type of insurance provides coverage for a specific term, offering flexibility and cost-effectiveness.

Unraveling the Benefits

Navigating the Landscape of Life Insurance Benefits: Now that the importance is clear, let's unfold the array of benefits that come with securing the best life insurance for the self-employed

Financial Security Beyond Boundaries

-

Life insurance acts as a financial cushion, ensuring that your loved ones are not left grappling with financial uncertainties.

-

It extends its protective wings, covering outstanding debts, mortgages, and other financial responsibilities.

Best Term Insurance Plan - Tailored for Your Needs

-

The self-employed have unique financial requirements, and the best term insurance plan is crafted to address these specific needs.

-

Flexibility in choosing the term duration and coverage amount empowers you to tailor the plan according to your business dynamics.

Top Term Insurance Plan - A Shield Against the Unpredictable

-

Opting for a top-term insurance plan provides comprehensive coverage, safeguarding your family's future against the unexpected.

-

It ensures that your loved ones maintain their lifestyle and financial stability, even in your absence.

Weaving a Future of Security

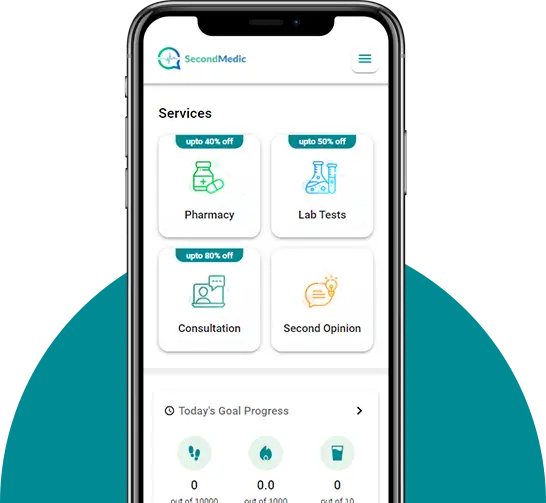

Online Doctor Consultation - Integrating Health into Financial Planning

-

In the pursuit of holistic well-being, some life insurance plans offer added perks like online doctor consultation.

-

Prioritizing health not only benefits you but also contributes to lower premium rates and enhanced coverage.

Planning for Education and Milestones

-

Life insurance isn't just about the present; it's a tool for future planning.

-

Secure your children's education, plan for their milestones, and create a financial legacy that resonates with your values.

Choosing Your Guardian Shield

Research and Compare - Finding the Best Fit

-

Start your journey by researching and comparing different life insurance options.

-

Look for plans that align with your specific needs, considering factors like coverage, premium rates, and additional benefits.

Consultation - Guiding You to Informed Decisions

-

Seek guidance from financial advisors and insurance experts.

-

An expert consultation helps you understand the nuances of different policies, ensuring you make an informed decision tailored to your self-employed lifestyle.

Application Process - Simplifying the Path to Security

-

The application process for life insurance has evolved, with many providers offering online applications.

-

Embrace the convenience and take the necessary steps to secure your financial future seamlessly.

Conclusion:

In the dynamic world of self-employment, life insurance transcends its role as a mere protector; it stands as a cornerstone for building a lasting financial legacy. Opting for the right policy becomes more than a responsibility; it becomes an act of profound love for those who hold a special place in our lives. Beyond providing a safety net, life insurance becomes a powerful tool that safeguards not just financial assets but the dreams and aspirations cultivated through tireless efforts. As entrepreneurs navigate the unpredictable terrain, this commitment to a resilient future ensures that uncertainties are met with the unwavering assurance of a secure legacy. It transforms life insurance into a testament of foresight and care, fostering a sense of reassurance and preparedness. Embrace the journey of securing tomorrow, where the significance of life insurance extends beyond the individual, creating a beacon of stability and prosperity for generations to come.

Read FAQs

A. Life insurance is crucial for the self-employed as it serves as a financial safety net, providing protection and security for both the individual and their loved ones in the face of uncertainties.

A. The role of life insurance extends beyond protection; it acts as a vital tool in crafting a lasting financial legacy. It safeguards dreams and aspirations, ensuring stability amidst the unpredictable journey of life.

A. The primary purpose of life insurance is to provide financial security for the insured individual and their beneficiaries. It ensures that in the event of the insured's demise, financial obligations, debts, and future plans are adequately covered, offering peace of mind to loved ones.