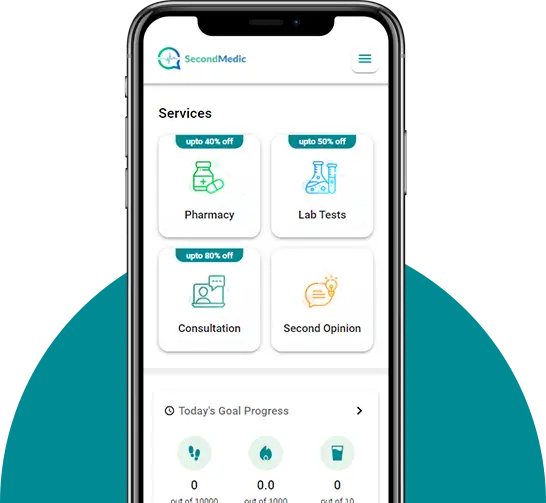

Transform Your Heart Health With

SecondMedic Elite

Health Plan

Pay as little as ₹83/Month

Health plan offering exclusive benefits to safeguard your well-being and finances. With this plan, you'll enjoy 25% off on medicines, 70% off on lab tests, and 65% off on health packages, ensuring affordability and accessibility to essential healthcare services.

430+ Happy Customers

Why Choose

SecondMedic Health Plans

At SecondMedic, we understand that your health is your most valuable asset. That's why

we offer a range of flexible healthcare membership plans designed to provide you with

comprehensive coverage and peace of mind.

Our Health Plans are designed to cater to your individual needs and preferences,

ensuring you receive the best possible care.

Health Membership Plans

Benefits of health plans

Access to Medical Care

Health plans provide access to a network of healthcare professionals, specialists, and facilities.

Preventive Services

Many health plans cover preventive services such as vaccinations, screenings, and annual check-ups.

Financial Protection

Health plans offer financial protection by covering a significant portion of medical expenses.

Prescription Drug Coverage

Health plans often include prescription drug coverage, making essential medications affordable.

How Our Virtual OPD Plan Works

You are just a few clicks away from healthcare you can trust.

Step 1

Tell us about yourself and your healthcare needs.

Step 2

We match you to a variety of plans with details to answer your questions.

Step 3

Our experts help you enroll and secure your OPD coverage online or by phone.

Our Blog

Videos

Testimonials

Vishal Chauhan, Dehradun

I’ve already referred three friends to Secondmedic after my own great exper Read More

Anurag Kapoor, Amritsar

From the person answering calls to the nurse who visited us, every Secondmedi Read More

Deepa S., Noida

The wellness webinar I attended taught me so much about managing my blood sug Read More

Manoj Gupta, Jaipur

We weren’t sure about a major surgery recommendation, so we reached out to Read More

Rahul Sen, Thane

I took the CPR course offered by Secondmedic and feel confident handling emer Read More

Isha Khandelwal, Jaipur

My grandfather receives regular health monitoring through their elder care se Read More

Sunita Rao, Nagpur

I ordered my son’s asthma medication and received it within hours. The deli Read More

Rina Das, Noida

We partnered with Secondmedic for our 50-member office and the onboarding was Read More

Ankit Chauhan, Ahmedabad

Whether it’s a virtual doctor consult, getting my blood pressure checked, o Read More

Rajat Malhotra, Guwahati

Just changing a few habits based on their health coaching made a noticeable d Read More

Myths About Health Care Membership Plans

Health care membership plans differ from traditional insurance. While insurance typically covers a broad range of medical expenses, membership plans often focus on specific services or providers. They may not cover all types of care, so it's important to carefully review the plan's coverage.

Membership plans often have limitations in terms of covered services. Procedures or treatments that are not within the scope of the plan's offerings may not be covered. It's crucial to understand what services are included and excluded.

Insurance plans are subject to specific regulations and oversight, ensuring certain standards of coverage and financial stability. Membership plans might not have the same level of regulation, which means you should thoroughly research the provider's reputation and financial stability.

While some membership plans can be cost-effective, it's not a guarantee. The cost-effectiveness depends on factors such as your health needs, the services covered, and how frequently you use the plan. Compare the plan's costs with potential out-of-pocket expenses to determine if it's truly economical for you.

Popular queries

Expert answers to your health queries from top doctors!

Telehealth plans provide coverage for virtual medical consultations and remote healthcare services. These plans are designed to help individuals access medical care from the comfort of their own homes, using technology such as video conferencing, telephone calls, or mobile apps.

Here are some key features of telehealth plans

-

Coverage: These plans typically provide coverage for virtual medical consultations with doctors, as well as other remote healthcare services such as telemedicine, telepsychiatry, and home healthcare.

-

Network: Check whether the plan has a wide network of healthcare providers who offer virtual consultations or remote healthcare services.

-

Waiting period: Look for a plan that has a short waiting period, so you can start using the benefits as soon as possible.

-

Premium: Compare the premium of different plans and choose one that fits your budget.

-

Additional benefits: Some plans may offer additional benefits such as wellness programs or coverage for alternative treatments.

When comparing telehealth plans in India, it's important to carefully review the plan details, including the covered services, premiums, deductibles, and out-of-pocket costs. Make sure you choose a plan that meets your specific healthcare needs and fits your budget. You can compare plans from different insurance providers by visiting their websites or using online insurance comparison websites. It's also important to check with the insurance provider whether virtual consultations with doctors and other remote healthcare services are included in the plan or offered as an add-on benefit.

Here are some additional factors to consider when comparing health plans

-

Pre-existing conditions: Look for a plan that offers coverage for pre-existing conditions, or at least has a shorter waiting period for such conditions.

-

Maternity coverage: If you are planning to start a family, look for a plan that offers comprehensive coverage for maternity expenses, including prenatal and postnatal care, hospitalization, and delivery.

-

Critical illness coverage: Some health plans may offer coverage for critical illnesses, such as cancer, heart disease, or kidney failure. This coverage can help you manage the high cost of treatment for these conditions.

-

No-claim bonus: Look for a plan that offers a no-claim bonus, which is a discount on your premium for every year you don't make a claim.

-

Exclusions: Review the exclusions of the plan to ensure that it does not exclude coverage for medical treatments that are important to you.

-

Claim settlement ratio: Check the claim settlement ratio of the insurance provider, which is the percentage of claims settled by the provider. A higher ratio indicates a better track record of claim settlement.

-

Customer service: Look for an insurance provider with good customer service and a responsive claims process, so you can get the assistance you need when you need it.

By considering these factors and carefully reviewing the details of each plan, you can make an informed decision about which health plan in India is best for you and your family.