- Published on: Jan 02, 2026

- 4 minute read

- By: Secondmedic Expert

Quit Smoking With Secondmedic: A Structured, Medically Guided Path To A Smoke-Free Life

Smoking remains one of the leading preventable causes of disease and premature death. Despite widespread awareness of its harmful effects, millions of people continue to smoke due to nicotine addiction, stress, habit formation and lack of structured support. Quitting smoking is not merely a matter of willpower; it is a medical and behavioural challenge that requires the right guidance.

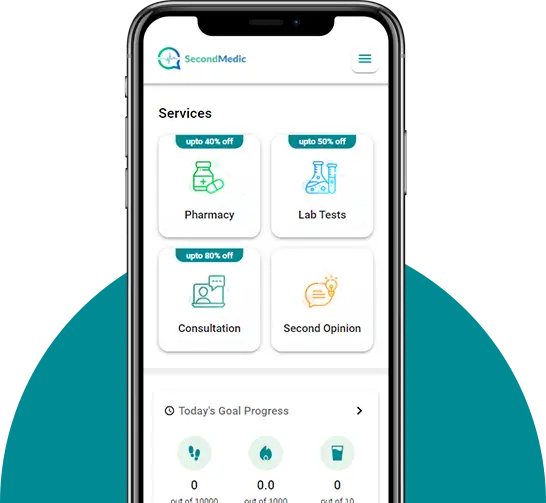

This is where Quit Smoking with Secondmedic becomes a powerful preventive healthcare solution. By combining medical expertise, behavioural science and digital health tools, Secondmedic helps individuals quit smoking safely, effectively and sustainably.

Why Smoking Is a Major Public Health Concern

According to Indian public health data:

-

Tobacco use is linked to heart disease, stroke, lung disease and multiple cancers

-

Smokers face significantly higher healthcare costs

-

Second-hand smoke affects families and communities

The World Health Organization identifies tobacco use as one of the largest global health threats, responsible for millions of deaths annually.

Why Quitting Smoking Is So Difficult

Nicotine addiction alters brain chemistry by:

-

stimulating dopamine release

-

reinforcing reward pathways

-

creating withdrawal symptoms when intake stops

Common challenges include:

-

cravings

-

irritability

-

anxiety

-

sleep disturbance

-

relapse during stress

Without support, many people relapse within weeks.

Health Benefits of Quitting Smoking

Quitting smoking leads to rapid and long-term benefits:

-

within weeks: improved circulation and lung function

-

within months: reduced cough and breathlessness

-

within years: significantly lower risk of heart disease, stroke and cancer

The body begins healing almost immediately after quitting.

Why Medical Guidance Matters in Smoking Cessation

Medical supervision helps:

-

assess addiction severity

-

manage withdrawal symptoms

-

address co-existing health conditions

-

reduce relapse risk

Evidence shows that doctor-guided cessation programs have much higher success rates than unaided attempts.

How Secondmedic Helps You Quit Smoking

Doctor-Led Consultations

Secondmedic connects individuals with qualified doctors who:

-

assess smoking history

-

identify health risks

-

create personalised quit plans

Behavioural Counselling and Support

Smoking is as much behavioural as it is chemical.

Structured counselling helps:

-

identify triggers

-

manage cravings

-

build healthier coping mechanisms

Preventive Health Integration

Smoking cessation is integrated with:

-

heart health screening

-

lung health assessment

-

metabolic risk evaluation

This holistic approach addresses overall wellbeing.

Digital Health Monitoring

Secondmedic uses digital tools to:

-

track progress

-

monitor symptoms

-

provide reminders and motivation

Continuous support improves adherence.

Addressing Withdrawal Symptoms Safely

Withdrawal symptoms are temporary but challenging.

With proper guidance:

-

cravings reduce gradually

-

mood stabilises

-

sleep patterns improve

Medical supervision ensures safety and comfort during this phase.

Who Should Consider Quitting with Medical Support?

Medical guidance is especially important for:

-

long-term smokers

-

individuals with heart or lung disease

-

people with diabetes or hypertension

-

those who have relapsed multiple times

Structured programs increase success.

The Role of Preventive Healthcare in Tobacco Cessation

Smoking cessation is one of the most cost-effective preventive interventions.

According to WHO and NITI Aayog:

-

quitting tobacco significantly reduces healthcare burden

-

workplace and digital cessation programs improve outcomes

-

preventive care saves lives and costs

Secondmedic’s approach aligns with these global recommendations.

Psychological and Lifestyle Support

Quitting smoking also involves:

-

stress management

-

improving sleep

-

adopting healthier routines

-

rebuilding self-confidence

Secondmedic addresses these aspects as part of long-term success.

Long-Term Success and Relapse Prevention

Relapse prevention focuses on:

-

ongoing follow-ups

-

lifestyle reinforcement

-

early intervention during high-risk situations

Consistent support transforms quitting into a permanent change.

Why Choose Secondmedic to Quit Smoking

Secondmedic offers:

-

doctor-led care

-

evidence-based protocols

-

digital convenience

-

preventive health focus

-

personalised guidance

This combination creates a safe and sustainable path to quitting.

Conclusion

Quitting smoking is one of the most important decisions for long-term health, but it does not have to be a lonely or overwhelming journey. Quit Smoking with Secondmedic provides a structured, medically guided and preventive approach that addresses both the physical and behavioural aspects of nicotine addiction. With expert support, digital monitoring and holistic care, individuals can break free from tobacco dependence and move toward a healthier, smoke-free life.

References

-

World Health Organization – Tobacco Control and Smoking Cessation Guideline

-

Indian Council of Medical Research – Tobacco Use and Disease Burden in India

-

NITI Aayog – Preventive Healthcare and Non-Communicable Diseases Report

-

Lancet – Smoking Cessation Interventions and Health Outcomes

-

NFHS-5 – Tobacco Consumption and Health Indicators in India

-

EY-FICCI – Preventive Healthcare and Digital Health Reports

Read FAQs

A. Nicotine addiction affects brain chemistry, making relapse common without medical and behavioural guidance.

A. Through doctor consultations, behavioural counselling, preventive care plans and digital monitoring.

A. Yes. Health benefits begin within weeks, regardless of age or duration of smoking.