- Published on: Oct 24, 2025

- 3 minute read

- By: Secondmedic Expert

Healthcare Insurance In India: Protecting Health, Empowering Lives With SecondMedic

Health is priceless, but healthcare can be expensive. In a country where medical inflation rises by nearly 12% every year, healthcare insurance has become a necessity, not a luxury.

SecondMedic bridges medical protection with digital convenience — giving Indians a smarter, simpler way to stay covered and cared for.

What Is Healthcare Insurance?

Healthcare insurance is a financial safety net that covers hospitalization, treatment, and medical expenses. It ensures you get access to top-quality hospitals without worrying about unexpected bills.

Modern health plans now go beyond emergencies — they cover preventive care, teleconsultations, home diagnostics, and even digital wellness programs.

Why Healthcare Insurance Is Essential in India

A 2024 report by IRDAI (Insurance Regulatory and Development Authority of India) found that over 70% of Indians pay medical bills out-of-pocket. One hospitalization can wipe out an entire year’s savings for a middle-income family.

Healthcare insurance:

-

Protects against medical inflation

-

Enables cashless hospitalization

-

Provides tax benefits under Section 80D

-

Encourages early detection via preventive checkups

-

Supports virtual consultations and chronic care follow-ups

Types of Healthcare Insurance Plans

1. Individual Health Plans

Covers one person — ideal for self-employed or single professionals.

2. Family Floater Plans

A shared sum insured for the whole family — cost-effective for parents and children.

3. Senior Citizen Plans

Customized for people aged 60+, including chronic disease and home care support.

4. Corporate & Group Insurance

Employer-provided coverage with wellness programs and digital consultation access.

5. Top-Up & Super Top-Up Plans

Extend existing coverage limits at low cost.

SecondMedic’s Role in Smarter Health Coverage

SecondMedic doesn’t just help you buy insurance — it helps you live healthier under it.

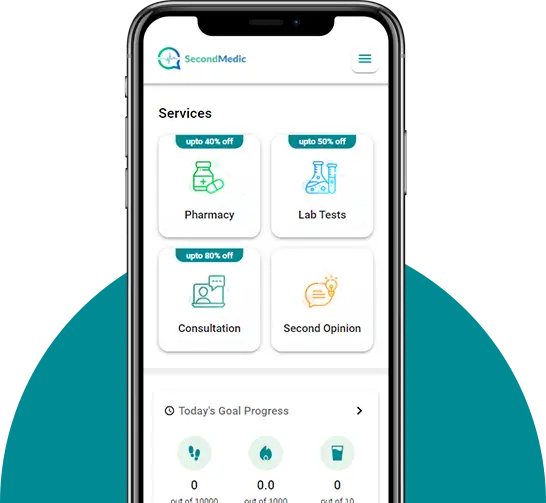

Our integrated Digital Health + Insurance model provides:

-

Cashless virtual consultations

-

Coverage-linked diagnostics (home or lab-based)

-

E-prescriptions & discounted pharmacy

-

AI-based health score tracking

-

Doctor guidance for claims and follow-ups

This ensures that insurance is used proactively, not just in emergencies.

Preventive Care + Insurance: A Winning Combo

Insurance companies now reward preventive care. By getting regular SecondMedic checkups, your health data helps keep premiums lower and claim-free bonuses active.

A NITI Aayog 2024 report found that preventive health monitoring reduced hospitalization risk by 28% among insured individuals.

Digital Health Meets Insurance

With SecondMedic’s tech-driven model, your insurance can now include:

-

Online doctor consultations

-

Chronic care management

-

Home sample collections

-

Telemedicine coverage

-

Digital health reports for easy claims

You can view your policy benefits, upload claims, and access your medical records — all through your SecondMedic dashboard.

How to Choose the Right Healthcare Insurance

-

Assess your medical history and family needs.

-

Compare premiums, claim ratios, and network hospitals.

-

Choose plans with telehealth, diagnostics, and preventive cover.

-

Check waiting periods for pre-existing conditions.

-

Use SecondMedic’s plan comparison tool for expert-backed guidance.

Conclusion

Healthcare insurance is not just a policy — it’s peace of mind.

By combining medical coverage with digital healthcare and preventive wellness, SecondMedic ensures that protection is proactive, not reactive.

Whether you need basic health cover or a comprehensive family plan, SecondMedic makes the journey simple, transparent, and fully online.

Compare and choose your healthcare insurance plan today at SecondMedic.com — because your health deserves both care and security.

Real Data & References

-

IRDAI Report 2024: 70% of Indians still pay medical bills out-of-pocket.

irdai.gov.in

-

NITI Aayog 2024: Preventive health reduces hospitalizations by 28%.

niti.gov.in

-

WHO India 2023: 50% of health issues preventable through early care.

who.int/india

-

SecondMedic Data (2025): 67% users prefer health plans with digital consultations.

secondmedic.com

Read FAQs

A. Healthcare insurance covers your medical expenses, including hospitalization, diagnostics, and sometimes even preventive health checkups, ensuring financial security during illness.

A. With rising medical costs, health insurance prevents out-of-pocket expenses and ensures access to quality hospitals and doctors.

A. SecondMedic partners with leading insurers to offer curated health protection plans, combining insurance, preventive checkups, and teleconsultations.

A. Yes. Many modern plans (especially those integrated with SecondMedic) now include telehealth, e-prescriptions, and digital wellness benefits.

A. You can compare and purchase verified plans on SecondMedic.com, or connect with a SecondMedic advisor for personalized guidance.