- Published on: Feb 09, 2020

- 4 minute read

- By: Raj Dwivedi

Health Insurance And Second Opinions: Your Comprehensive Guide

Have you ever found yourself in a situation where a medical condition left you pondering whether to seek a second opinion? In such moments, the cost associated with additional consultations might concern you. This leads to a crucial question: Does your health insurance cover second opinions? In this comprehensive exploration, we delve into the realm of health insurance coverage, shedding light on the benefits, coverage options, and the role of insurance policies in obtaining second opinions.

Understanding Health Insurance Second Opinion Coverage

When it comes to your health, having the option to seek a second opinion can be invaluable. Health insurance providers recognize this, and many plans include coverage for second opinions. Here's what you need to know:

-

Medical Second Opinion Coverage: A growing number of health insurance plans now offer coverage for seeking a second opinion on medical diagnoses or treatment options. This coverage can extend to various medical specialties.

-

Insurance Benefits for Second Opinions: Explore your insurance policy to understand the specific benefits related to second opinions. Some plans may cover the entire cost, while others might require a copayment or coinsurance.

-

Healthcare Coverage Options: Different insurance plans offer varying levels of coverage for second opinions. Understanding your plan's specifics is crucial to making informed decisions about seeking additional medical advice.

The Importance of Second Opinions in Healthcare

Second opinions play a significant role in healthcare decision-making. They provide patients with reassurance, alternative treatment options, and potentially life-saving insights. Here's why they matter:

-

Confirming Diagnoses and Treatment Plans: Second opinions can verify a diagnosis or recommend a different treatment path, ensuring you receive the most accurate care.

-

Exploring Alternative Options: It's common for different doctors to have varied perspectives on treatment, which can provide you with alternatives tailored to your preferences and circumstances.

-

Complex or Serious Conditions: In cases involving complex or serious medical conditions, seeking a second opinion is often recommended to ensure the best possible care.

Unraveling the Complexities: Insurance Policy and Second Opinions

To make the most of your health insurance coverage for second opinions, it's essential to comprehend the details within your insurance policy.

-

Health Plan Consultation Coverage: Some insurance policies may explicitly include coverage for consultations with specialists or experts. This can be particularly beneficial when seeking a second opinion from a renowned healthcare professional.

-

Coverage for Medical Advice: While second opinions are often associated with diagnosis and treatment, certain insurance plans may extend coverage to general medical advice. This can be a valuable resource for maintaining overall health and well-being.

-

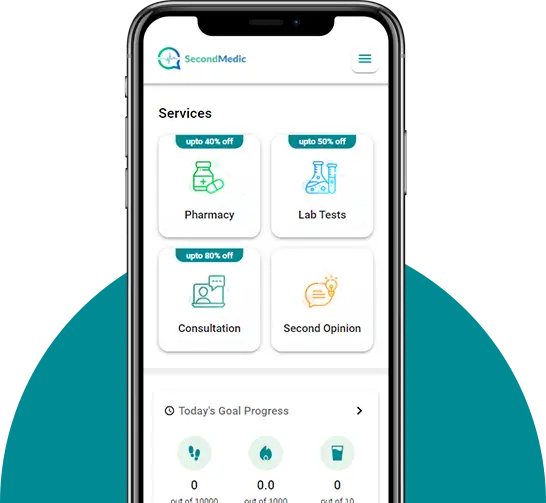

Online Doctor Consultation: In the digital age, online consultations are becoming increasingly prevalent. Check if your insurance plan covers virtual consultations, offering you the flexibility to seek second opinions remotely.

Factors Influencing Coverage

Understanding the factors that influence coverage for second opinions can help you navigate the nuances of your insurance policy:

-

Policy Type and Provider Networks: Different insurance plans, such as HMOs or PPOs, may have varying rules regarding second opinions and provider networks. Being within the network can impact coverage.

-

Pre-Authorization Requirements: Some insurance companies may require pre-authorization or referrals from your primary care physician before covering a second opinion. Understanding these requirements is crucial.

-

Out-of-Network Options: While in-network consultations are often covered, seeking a second opinion from an out-of-network specialist may result in different coverage terms or higher out-of-pocket costs.

Empowering Decision-Making: The Role of Health Insurance Information

Armed with a deeper understanding of health insurance coverage for second opinions, you can now proactively engage with your insurance provider:

-

Evaluate Your Coverage: Review your insurance policy documents to identify clauses related to second opinions. Pay attention to any limitations, such as pre-authorization requirements or network restrictions.

-

Engage with Your Provider: If uncertainties persist, reach out to your insurance provider for clarification. Understanding the intricacies of your coverage ensures that you can make informed decisions when seeking a second opinion.

-

Explore Additional Benefits: Beyond second opinions, investigate other benefits your health insurance plan may offer, such as wellness programs, preventive care coverage, or telemedicine services.

The Importance of Advocacy in Healthcare

Navigating the healthcare system can be complex, but being your own advocate is empowering. Here's how you can advocate for yourself:

-

Ask Questions: Don't hesitate to ask your healthcare providers and insurance company any questions you may have. Clear communication leads to better understanding.

-

Seek Support: Consider involving a trusted advocate, such as a family member or friend, when navigating insurance policies and healthcare decisions. They can provide valuable support and perspective.

-

Stay Informed: Continuously educate yourself about your insurance coverage and healthcare options. Being well-informed enables you to make confident choices regarding your health.

Empowering Individuals: A Call to Action

Now that you are well-versed in the nuances of health insurance coverage for second opinions, take proactive steps to leverage this aspect of your healthcare plan:

-

Initiate Conversations: Discuss the possibility of seeking a second opinion with your primary healthcare provider. They can provide guidance and, if necessary, refer you to specialists covered by your insurance.

-

Document Your Journey: Keep records of your communications with both healthcare professionals and your insurance provider. This documentation can be invaluable in case of disputes or when navigating the complex landscape of healthcare billing.

-

Embrace the Digital Era: Explore online doctor consultation options covered by your insurance. Virtual second opinions can offer convenience and accessibility, especially in situations where in-person visits may be challenging.

The Power of Informed Healthcare Decisions

Informed decisions about healthcare empower individuals to take charge of their well-being. Seeking second opinions within the framework of your insurance coverage enhances this empowerment:

-

Enhanced Confidence: Knowing that your insurance covers second opinions provides the confidence to seek additional medical advice without financial worries.

-

Improved Health Outcomes: Accessing diverse medical opinions often leads to better-informed treatment decisions, potentially resulting in improved health outcomes.

-

Financial Peace of Mind: Understanding your insurance coverage for second opinions alleviates concerns about unexpected expenses, allowing you to focus on your health.

Conclusion

Your health insurance can serve as a valuable ally when considering second opinions. By navigating the intricacies of your policy, understanding coverage options, and taking proactive steps, you empower yourself to make informed decisions about your healthcare. Remember, the key lies in unlocking the full potential of your health insurance for a healthier and more secure future.

Read FAQs

A. A second opinion in health insurance refers to seeking advice from another healthcare professional to validate or explore alternative diagnoses, treatments, or procedures. Many insurance plans cover the cost of obtaining a second opinion for specific medical conditions.

A. To obtain a second opinion on the NHS, start by discussing your concerns with your primary healthcare provider. They can refer you to another NHS specialist for a second opinion. You can express your preference for a specific doctor or request a referral to a specialist with expertise in your condition. Engaging in an open and honest conversation with your healthcare provider is key to initiating the process.

A. If your doctor is hesitant to refer you to a specialist, it could be due to their confidence in managing your condition within their expertise or a belief that the issue can be effectively addressed without specialist intervention. Insurance requirements, limited specialist availability, and patient preferences might also influence this decision. Engage in an open conversation with your doctor to understand their reasoning and discuss the potential benefits of involving a specialist in your care.